owe state taxes california

Get Your Qualification Analysis Done Today. For the latest tax year your California corporation had taxable net income of 100000.

California S Tax System A Primer

See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems.

. 100 of the amount due. Other things being equal your corporation will owe California. Up to 25 cash back Example.

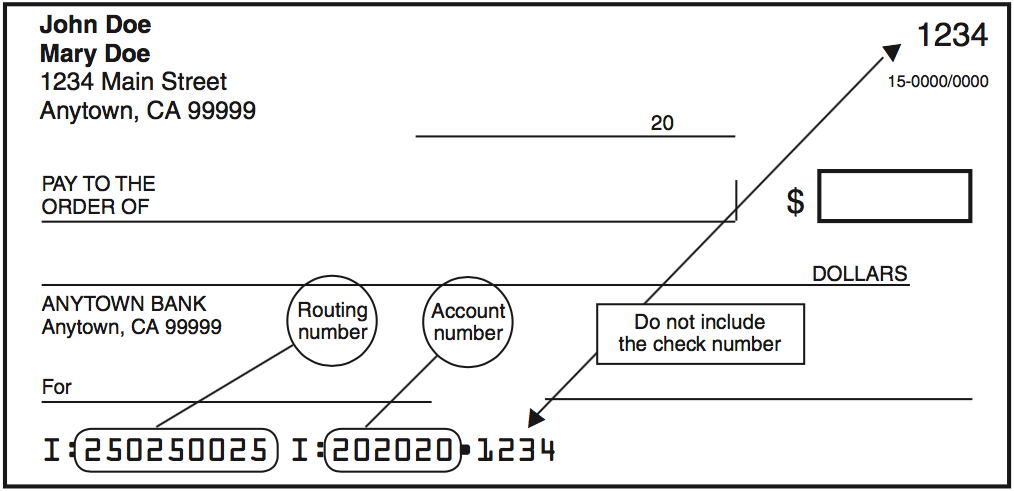

Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. If you had money. Resolve your tax issues permanently.

The Different Types of. If your tax return shows a balance due of 540 or less the penalty is either. 9 rows California state tax rates are 1 2 4 6 8 93 103 113 and 123.

California State Tax Quick Facts. If you do not owe taxes or have to file you may be able to get a refund. California income taxes vary between 1 and 123.

FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other. This can pay anywhere from 255 to 6728.

Important State gas price and other relief proposals. If youre required to make estimated tax payments and your prior year California adjusted gross income is more than. Our partnership of tax agencies includes Board of Equalization California Department of Tax.

Get free competing quotes from the best. It comes in fourth for combined income and sales tax. Then you must base.

75000 if marriedRDP filing separately. Whichever amount is less. The maximum penalty is 25.

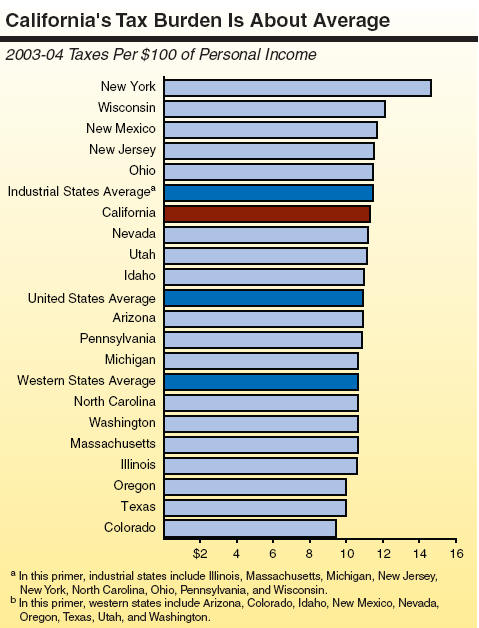

California for instance has the highest state income tax rate in the United States. Ad Quickly End IRS State Tax Problems. Take Avantage of IRS Fresh Start.

The deadline is October 17 2022. We give you an automatic 6-month extension to file your return. Both personal and business taxes are paid to the state.

Ad Dont Face the IRS Alone. If You Owe Taxes Get A Free Consultation for IRS Tax Relief. Welcome to the California Tax Service Center sponsored by the California Fed State Partnership.

073 average effective rate. You can get up to 3027. 5110 cents per gallon of regular.

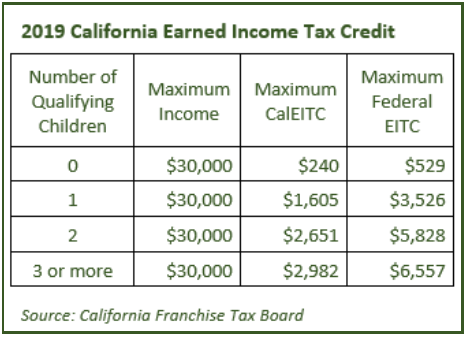

Its tax sits at 133. If you qualify for the California Earned Income Tax Credit EITC 7. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other.

For example if you owe 5000 to the Internal Revenue Service and 1000 to your state offer your state 20 percent of your total payment each month and 80 percent to the IRS. Important State gas price and other relief proposals. Important State gas price and other relief proposals.

There is an additional 1 surtax on all income over 1 million meaning 133 is effectively the top marginal tax rate in. California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US. A 1 mental.

Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600. For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return. You must file by the deadline to avoid a late filing penalty.

There are 43 states that collect state income taxes. Ad Created By Former Tax Firm Owners Based on Factors They Know are Important. In California the lowest tax bracket is.

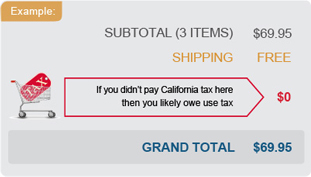

California Use Tax Information

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

California Ftb Rjs Law Tax Attorney San Diego

Where S My State Refund Track Your Refund In Every State Taxact Blog

Why Is My California Ca Tax Refund Taking So Long 2022 Payment Delay Updates Aving To Invest

Irs Form 540 California Resident Income Tax Return

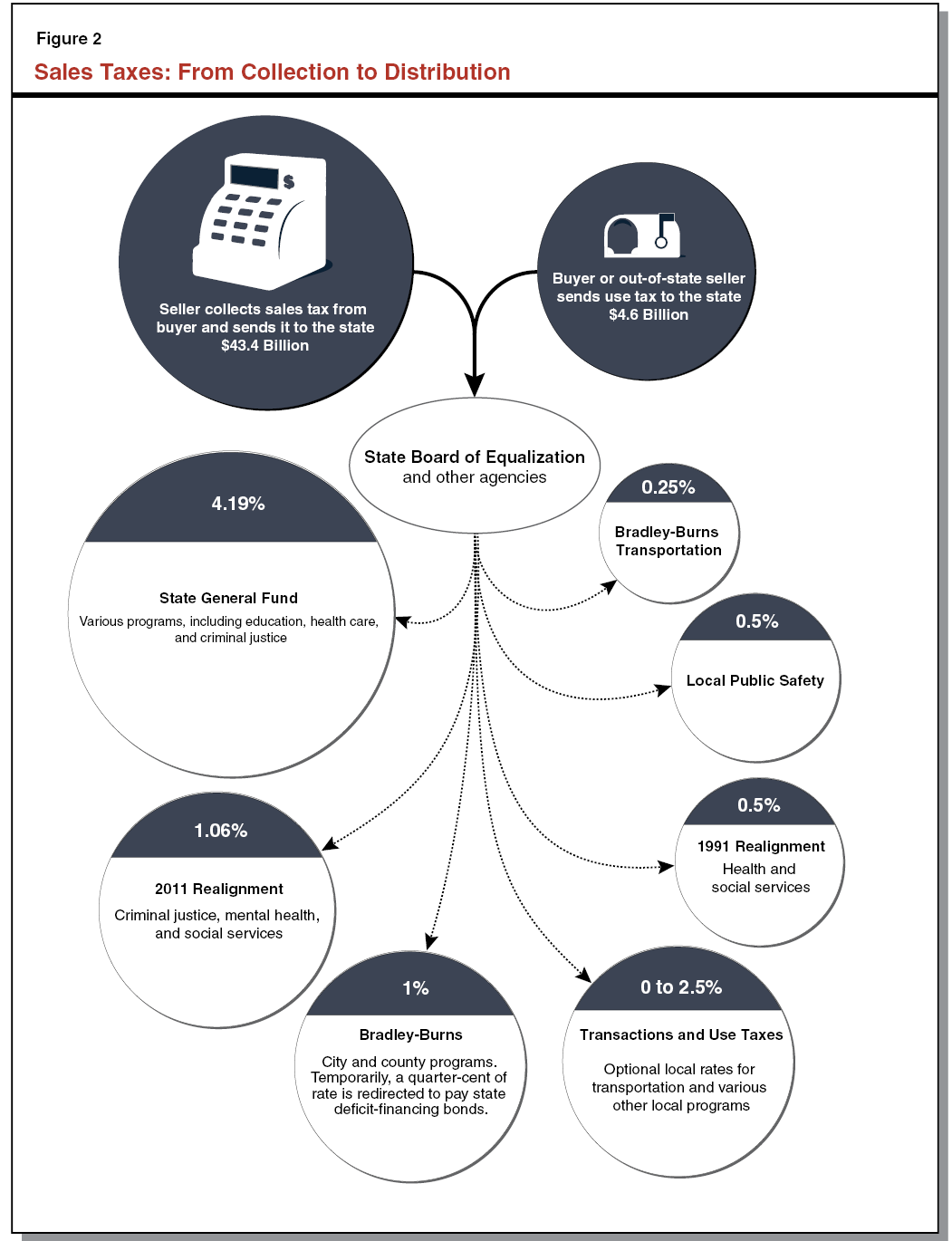

Understanding California S Sales Tax

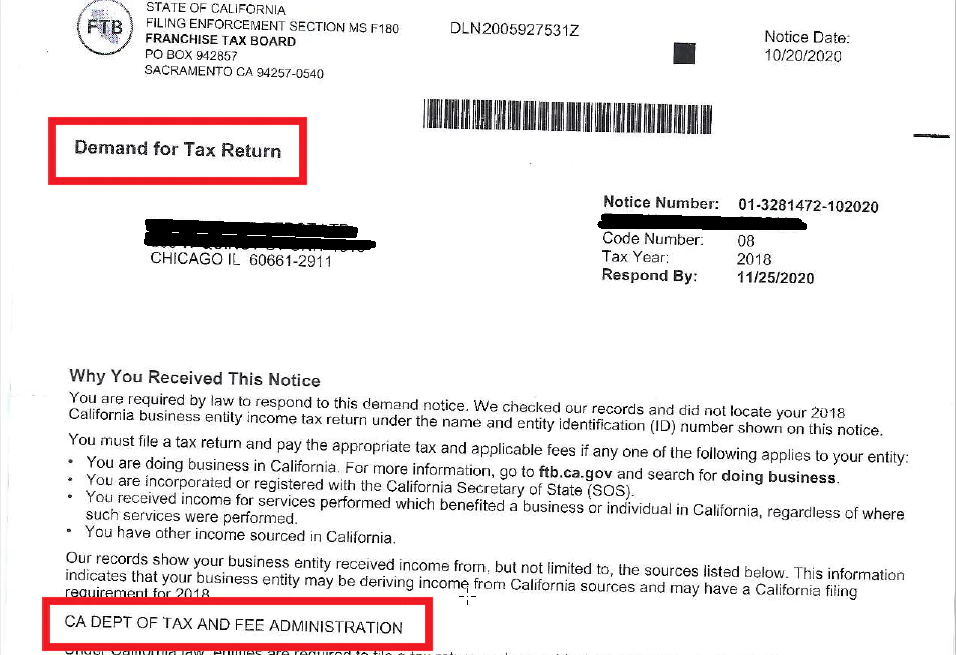

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

I Owe California Ca State Taxes And Can T Pay What Do I Do

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

You Owe Taxes In California What Happens Landmark Tax Group

Understanding California S Sales Tax

What Are California S Income Tax Brackets Rjs Law Tax Attorney

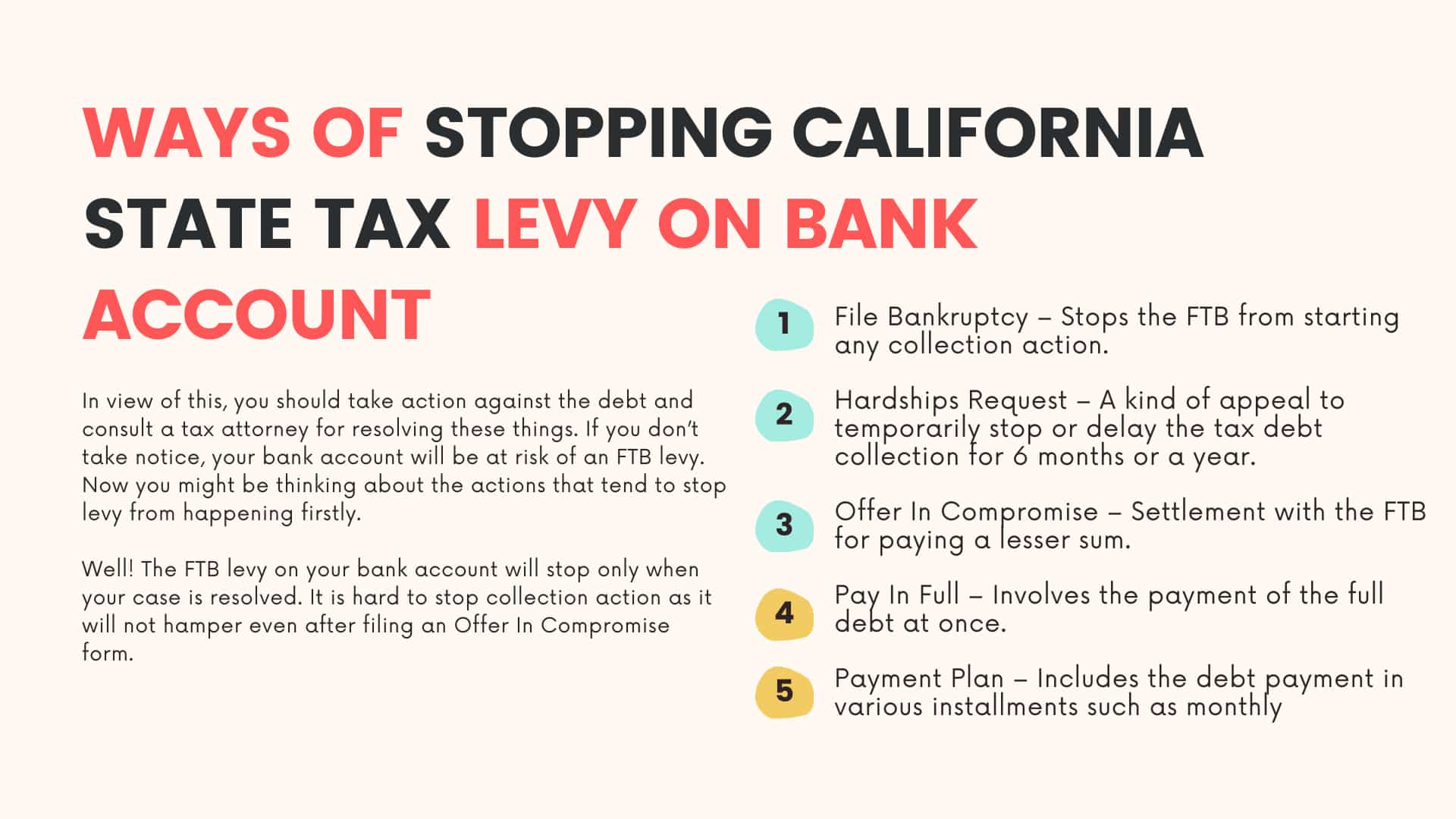

3 Proven Ways To Stop California State Tax Levy On Bank Account

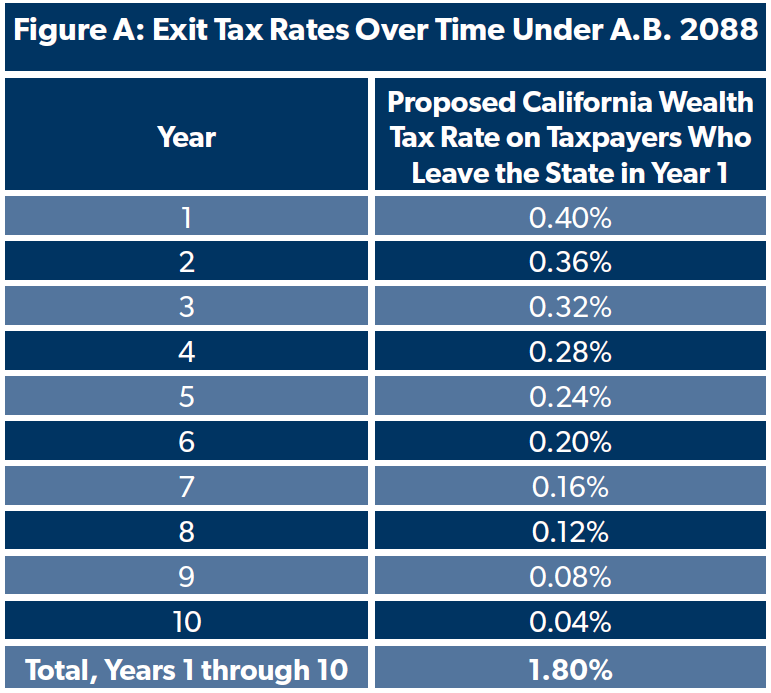

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

3 Proven Ways To Stop California State Tax Levy On Bank Account